marketing and sales

Best-in-Class Marketers Prove They Create Value

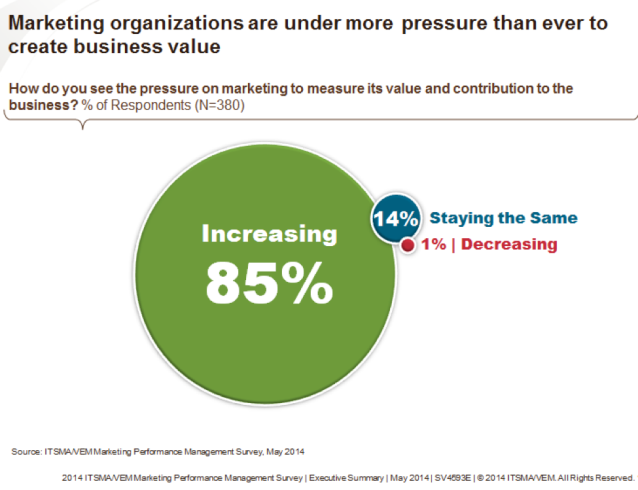

In 2000, the Advertising Research Foundation probably didn’t realize that their report about marketing’s ability, or lack thereof, to measure its value and contribution would initiate numerous studies, conferences, and products on the topic. This year’s joint VEM/ITSMA Marketing Performance Management Survey* , which looks at how marketers and C level executives would rate marketing’s value, revealed that 85 percent of the nearly 400 study participants are seeing increased pressure for marketers to measure marketing’s value and contribution.

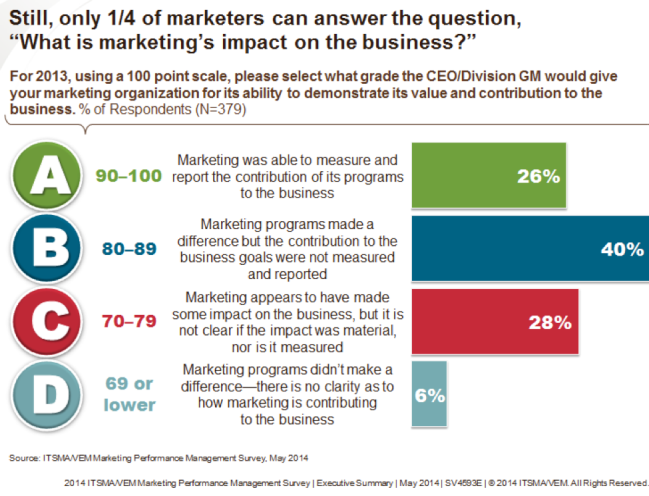

A key component of the annual study looks at the comparison of the number of marketers earning an ‘A’ grade from the C-Suite for their ability to impact the business and measure their value with their counterparts who are falling short. The grades remained relatively consistent with prior years, with only a quarter of the marketers earning an ‘A’ for their ability to measure and report the contribution of marketing’s programs to the business.

By now one would think this journey would be nearing completion, but there appears to still be plenty to learn. Over the years, the study has revealed that ‘A’ marketers exhibit a number of differences from their colleagues–they are better at alignment, accountability, analytics, automation, assessment, and alliances. The investments in these capabilities and how they approach the work of marketing has enabled them to serve as value creators for their organizations. On the other hand, the marketers in the “middle of the pack” focus more on enabling sales, and the laggards operate primarily as campaign or program producers. In this day and age, with all the technology that marketers have at their fingertips, it begs the question “Why can’t ‘B’ and ‘C’ marketers get close to C-level executives and show their value?”

Become a Value Generator

Marketing organizations that create value are proactive. The ‘A’ marketers hold themselves accountable for contributing to business outcomes even if senior leadership doesn’t. They believe it is their responsibility to identify, investigate, evaluate, recommend, and prioritize market and customer opportunities. These marketers implement continuous change to maximize the organization’s success, and enable it to stay abreast or ahead of market, customer, and competitor moves. ‘B’ and ‘C’ marketers don’t seem to do that, don’t ask the right questions, or don’t know how to show their value.

Make Marketing Performance Management a Priority

According to the data, organizations that are performing well when it comes to customer value and business growth, are those where the marketers excel at performance management. ‘A’ marketers prioritize performance management, establish a clear roadmap for performance improvement, and focus on aligning marketing to the business not just sales. They have regular two-way dialogue with senior leadership and are motivated to select and report on the metrics that matter most.

Here are three qualities of this elite group that any marketing organization can emulate:

- Be a business person first, a marketer second

- Provide customer and market insight to inform business strategy, in addition to enabling sales

- Tap experts to hone skills and improve capabilities

Join the conversation with VisionEdge Marketing and ITSMA in our webinar, The Link Between Performance Management and Value Creation, Tuesday, June 17th, from 10:00-11:00am CST.

*VEM has been conducting the survey for 13 years. ITSMA has co-sponsored the survey for the past three years.

Power Tools-Use with Caution

The results from the marketing performance research recently conducted jointly by ITSMA and VisionEdge Marketing (VEM), and Forrester were just announced. In its 12th year, the purpose of this study has been to understand how proficient marketers are at measuring and managing performance; using metrics, data, and analytics; and communicating marketing’s value, impact and contribution to the business. This year’s study captured input from more than 400 respondents. The study revealed areas in which marketers have made strides and areas where marketers remain challenged.

The result I found most perplexing was that, while marketers have access to more data than ever, leverage more analytics, and invest in more tools and systems, they continue to struggle to prove marketing’s contribution to the business. One clear indicator of this is that just 9% of CEOs and 6% of CFOs use marketing data to help make strategic decisions. Less than 10%! Although the majority of the marketers regularly produce and share a marketing dashboard, they are not bringing valuable, useful information to the table.

So where’s the disconnect? If you want your leadership team to understand how marketing is moving the needle in terms of top line revenue, market share, customer value, category ownership, and so on then the dashboard needs to be able to tell that story. Unfortunately, it appears that most marketers participating in the study use their marketing automation (MAP) or sales automation (CRM) systems to create their dashboards. In fact, dashboards and reports are already integrated into many of these systems. These dashboards, however, typically report on marketing activity and associated costs – email activity, website activity, social media activity, lead activity- rather than reporting on metrics executives can to set direction. It’s not that these reports and dashboards are bad; they are valuable when used to support tactical decisions, but if you want your CEO, CFO and other members of the C-Suite to use your dashboard it must clearly connect marketing investments and initiatives to business outcomes and results.

The ability to push a button and generate a pretty report that doesn’t add any value to the strategic decisions made at the C-Suite level doesn’t serve marketing well. To be on the right track, you need to start by making sure the marketing initiatives and investments are clearly aligned to business outcomes and that you have the right metrics in place. Otherwise, investing in better marketing tools is akin to buying a power saw when you have yet to master a hand saw. You have the ability to do more damage faster.

Learn more about the survey results and some initial impressions at:

- 2013 MPM StudyPress Release

- Laura Ramos’ blog post at Forrester

- Julie Schwartz’s blog post at ITSMA

Getting Sales to Accept More Qualified Leads

Would you like to reduce the number of qualified leads passed on by marketing that sales rejects? It’s a relatively easy disconnect to resolve. All it takes is marketing and sales collaborating around the definition of the various stages in the opportunity pipeline and a scoring methodology.

If you want to get serious about opportunity management, just follow these three steps:

1. Define Each Stage in the Buying Pipeline.

When marketing, sales, and management all speak the same language regarding opportunities in the pipeline, everyone can work together to nurture those opportunities most promising from a sales and revenue perspective. Therefore, it’s important to create a glossary of standard terms for what your company considers a contact, suspect, lead, qualified lead, prospect, and so forth.

The best way to do this is to outline the customer buying process based on observable behaviors, then mapping these to the appropriate opportunity stage. In this first step you will do your best to identify the behaviors of your customer buying process you can observe. But of course, you will want to validate this truly is their process.

To illustrate this idea, let’s suppose based on experience, research and customer input, your customers’ buying process includes the following behaviors:

• Registering for a Webinar.

• Subscribing to the company newsletter.

• Downloading a white paper.

• Downloading product literature.

• Participating in a live demo.

• Requesting or scheduling a meeting with their decision-maker.

• Requesting pricing information.

• Offering buying criteria.

• Providing budget and timing information.

• Requesting or participating in a product trial.

• Contacting references.

• Requesting an RFP.

• Conducting an internal review of all RFPs.

• Holding meetings with the top 1 to 2 suppliers selected from the RFP process.

Again, based on experience and research, determine which behaviors go into which stage of the pipeline. Using this example, we might map the behaviors below as follows:

• Registering for a Webinar and subscribing to the company newsletter represent the contact stage.

• Participating in a live demo and requesting a product sample represent the suspect stage.

• Requesting pricing information and scheduling an appointment with the decisionmaker represent the lead stage.

• Providing buying criteria, requesting to participate in a product trial, and requesting an RFP go into the qualified lead stage.

• Contacting references and holding meetings with the RFP finalists might represent the prospect stage.

While these most likely exemplify just a few behaviors in the buying process, hopefully you grasp the main idea: By using observable behaviors and mapping them to the pipeline, there is much less ambiguity. Once you complete and validate the behaviors and stages, create and publish an opportunity pipeline glossary that documents how your company defines each stage. This will help avoid confusion later.

2. Establish Ideal Behavioral and Fit Criteria.

Now that you’ve completed the first step, you can use the process to establish the criteria for the ideal opportunity. We recommend working from two key categories: the buying behaviors and fit. The latter helps determine whether the opportunity would be an ideal profitable customer for your organization.

Using all the behaviors you identified, select those that would suggest the opportunity is ready to buy. Then make a list of criteria for your fit category. For example, the opportunity is in a target vertical where you have domain expertise. Or your product is a “plug and play” way for them to solve their problem.

Now establish your threshold criteria. Select those criterion that serve as the gate for passing an opportunity to sales.

3. Develop an Opportunity Scoring Methodology.

A key part of your qualification should be the opportunity score. The concept of opportunity or lead scoring is relatively simple. Essentially, you assign points based on how well an opportunity meets each of your qualification criteria. To create your scoring method, assign points to all the buying behaviors, as well as the fit criteria. Then create some ranges to help with the granularity. This way you can assess an opportunity both in terms of the conversion potential and fit. To illustrate this idea let’s say we score some of the behaviors and fit as follows:

Fit

• In a target vertical where you have domain expertise: five points.

• In a target vertical where you don’t have domain expertise: three points.

• Not in a target vertical: no points.

• Your product is ideally suited to solve their problem: five points.

• Your product will solve their problem with some customization: three points.

• Your product will not solve their problem without a major investment on your part: no points.

Behaviors

• Meeting held with decision-maker: five points.

• Meeting held with recommender: three points.

• Meeting held with influencer: one point.

• Provided product specification and buying criteria: five points.

• Indicated they are funded: five points.

• Indicated budget is approved: three points.

• Contacted references: five points.

• Requested references: one point.

• Participated in on-site demo: five points.

• Participated in online demo: one point.

You will need to complete this point assignment process for all of the behaviors and fit criteria. As part of your scoring method you will also want to consider the volume of actions exhibited by the opportunity within a period of time as part of your criteria.

Establish your point criteria and volume thresholds—that is, what is the minimum number of points, minimum criteria, and minimum number of action an opportunity needs to meet in order to pass the opportunity to sales? You now have three components that comprise what constitutes a sales-worthy qualified lead: point, volume and criteria thresholds.

Sales agrees to accept opportunities that meet these thresholds and marketing agrees to only forward those opportunities. So for example, qualified leads must be at least 20 points and must include (at a minimum) the behaviors indicating they are funded, participated in an on-site demo, and are in a target vertical.

Now, score each opportunity. As a team, discuss what to do with those opportunities at various stages in the pipeline that don’t meet the thresholds, so they are appropriately nurtured.

Keep in mind, lead scores should evolve as you see changes in customer buying behavior. This will help optimize the accuracy of the lead score and your marketing efforts.