marketing performance measurement

Best-in-Class Marketers Prove They Create Value

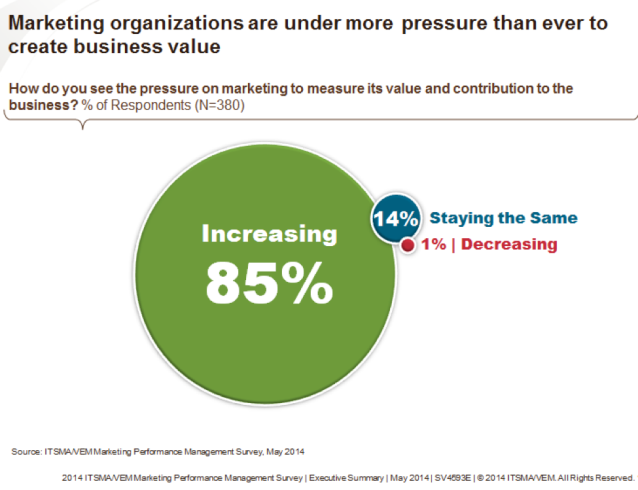

In 2000, the Advertising Research Foundation probably didn’t realize that their report about marketing’s ability, or lack thereof, to measure its value and contribution would initiate numerous studies, conferences, and products on the topic. This year’s joint VEM/ITSMA Marketing Performance Management Survey* , which looks at how marketers and C level executives would rate marketing’s value, revealed that 85 percent of the nearly 400 study participants are seeing increased pressure for marketers to measure marketing’s value and contribution.

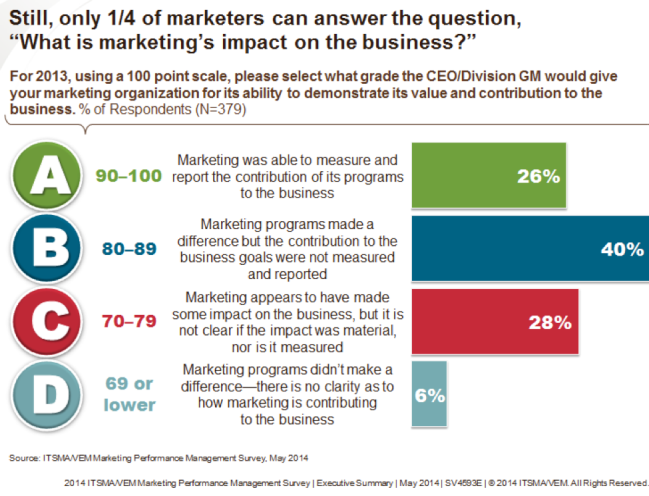

A key component of the annual study looks at the comparison of the number of marketers earning an ‘A’ grade from the C-Suite for their ability to impact the business and measure their value with their counterparts who are falling short. The grades remained relatively consistent with prior years, with only a quarter of the marketers earning an ‘A’ for their ability to measure and report the contribution of marketing’s programs to the business.

By now one would think this journey would be nearing completion, but there appears to still be plenty to learn. Over the years, the study has revealed that ‘A’ marketers exhibit a number of differences from their colleagues–they are better at alignment, accountability, analytics, automation, assessment, and alliances. The investments in these capabilities and how they approach the work of marketing has enabled them to serve as value creators for their organizations. On the other hand, the marketers in the “middle of the pack” focus more on enabling sales, and the laggards operate primarily as campaign or program producers. In this day and age, with all the technology that marketers have at their fingertips, it begs the question “Why can’t ‘B’ and ‘C’ marketers get close to C-level executives and show their value?”

Become a Value Generator

Marketing organizations that create value are proactive. The ‘A’ marketers hold themselves accountable for contributing to business outcomes even if senior leadership doesn’t. They believe it is their responsibility to identify, investigate, evaluate, recommend, and prioritize market and customer opportunities. These marketers implement continuous change to maximize the organization’s success, and enable it to stay abreast or ahead of market, customer, and competitor moves. ‘B’ and ‘C’ marketers don’t seem to do that, don’t ask the right questions, or don’t know how to show their value.

Make Marketing Performance Management a Priority

According to the data, organizations that are performing well when it comes to customer value and business growth, are those where the marketers excel at performance management. ‘A’ marketers prioritize performance management, establish a clear roadmap for performance improvement, and focus on aligning marketing to the business not just sales. They have regular two-way dialogue with senior leadership and are motivated to select and report on the metrics that matter most.

Here are three qualities of this elite group that any marketing organization can emulate:

- Be a business person first, a marketer second

- Provide customer and market insight to inform business strategy, in addition to enabling sales

- Tap experts to hone skills and improve capabilities

Join the conversation with VisionEdge Marketing and ITSMA in our webinar, The Link Between Performance Management and Value Creation, Tuesday, June 17th, from 10:00-11:00am CST.

*VEM has been conducting the survey for 13 years. ITSMA has co-sponsored the survey for the past three years.

Four Models Every Marketer Should Master

We know–models can be intimidating. But as the need to add analytics and science to our work continues to increase, models have become one of the primary vehicles every marketer needs to know how to develop and leverage. If you’ve already dived into the deep end on models, congratulations. On the other hand, if you’re just dipping your toe into the water, have no fear, because while there may be a bit of a current, it is time to venture forth.

Mathematical models help us describe and explain a “system,” such as a market segment or ecosystem. These models enable us to study the effects of different actions, so we can begin to make predictions about behavior, such as purchasing behavior. There are all kinds of mathematical models-statistical models, differential equations, and game theory.

Regardless of the type, all use data to transform an abstract structure into something we can more concretely manage, test, and manipulate. As the mounds of data pile up, it’s easy to lose sight of data application. Because data has become so prolific, you must first be clear about the scope of the model and the associated data sources before constructing any model.

So you’re ready to take the plunge–good for you! So, what models should be part of every marketer’s plan? Whether a novice or a master, we believe that every marketer must be able to build and employ at least four models:

- Customer Buying Model: Illustrates the purchasing decision journey for various customers (segments or persona based) to support pipeline engineering, content, touch point and channel decisions.

- Market Segmentation or Market Model: Provides the vehicle to evaluate the attractiveness of segments, market, or targets. More about this in today’s KeyPoint MPM section.

- Opportunity Scoring Model: Enables marketing and sales to agree on when opportunities are sales worthy and sales ready.

- Campaign Lift Model: Estimates the impact of a particular campaign on the buying behavior.

These four models are an excellent starting point for those of you who are just beginning to incorporate models into your marketing initiatives. For those who have already developed models within your marketing organization, we would love to know whether you have conquered these four, or even whether you agree these four should be at the top of the list. As always, we want to know what you think, so comment or tweet us with your response!

Free Benchmarking–Does Your Marketing Measure Up?

Here’s something we know after conducting the marketing performance measurement and management study since 2001: Best-in-Class marketers are relentless when it comes to continuous improvement. How do they know how they stack up? They regularly audit and benchmark. We know this can be expensive—even a small benchmarking study for marketing typically takes at least $20,000. With marketing budgets still feeling the crunch, it makes sense to be a bit more creative when it comes to benchmarking. And that’s where our annual marketing performance study comes in!

There are plenty of studies out there, and only you can decide which ones are worth your time. As a marketer you could probably complete a study every day, but if you are feeling the pressure to prove the value of your marketing, then this survey is for you. With 13 years under its belt and participation from marketing professionals and executives from around the world, in every industry and of all size organizations, we are able to provide a solid view into what Best-in-Class marketers do better and differently when it comes to measuring marketing’s contribution and value.

Given how hard you’re working every day, it’s frustrating when budgets are slashed and programs are terminated. You know Marketing is highly valuable to the business, but can you prove it? If you can, you may be among the ranks of the Best-in-Class—those marketers who have made marketing relevant to the C-Suite! If you can’t, it’s probably time to make some changes.

Find out how your organization stacks up against the Best-in-Class. Give 15 minutes of your time to participate in the 13th Annual MPM Survey and save the benchmarking dollars.

What does the survey benchmark? The focus of the survey is Marketing Alignment, Accountability, Analytics, Operations, and Performance Management capabilities. Complete the survey, share the link with your marketing colleagues and leadership team, and use the survey and the upcoming results to spark internal dialogue on the state of your marketing!

You can access the survey by following this link: https://www.surveymonkey.com/s/2014MPM_VEM

Efficiency vs. Effectiveness Metrics

In his book, The Effective Executive, Peter Drucker explained the difference between efficiency and effectiveness: “Efficiency is doing things right. Effectiveness is doing the right things.” He strongly advised focusing first on effectiveness before efficiency. Along with outcome-based and leading-indicators metrics, Marketers also need both efficiency and effectiveness metrics. Here’s an easy way to distinguish whether your metric is one or the other:

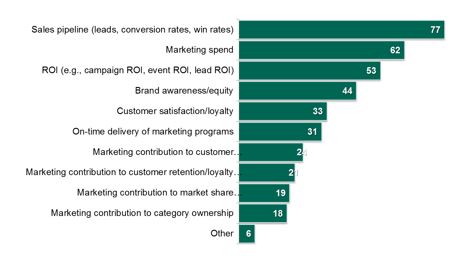

- If the metric is measuring how well you squeeze out waste or cost or measure maximum output for input, it’s most likely an efficiency metric. Marketing spend, ROI, and cost/per lead, lead/rep are examples of efficiency metrics.

- If the metric is measuring how well you are contributing to or producing a desired result, it is most likely an effectiveness metric. Share of preference, share of wallet, products/customers are examples of effectiveness metrics.

As we have learned from over a decade of research on marketing metrics, many marketers are doing a good job of establishing, monitoring, and managing efficiency metrics and not as good of a job with developing, measuring, and managing effectiveness metrics.

This propensity to focus on efficiency metrics ultimately creates a problem for marketing. You can be improving efficiency, which has nothing to do with whether or not what you are currently doing is the right thing to do, while not actually becoming less effective. Effectiveness is about achieving the right result, or being on the right path. When we are positively impacting and contributing to the right result, then we earn our right to participate in strategic conversations.

It may be easier to identify, track and manage efficiency metrics but that may not be the only reason we see more efficiency related metrics. Many people assume that they are on the right track so if and when there is a problem, they address it by trying to make the process more efficient without questioning whether they are going in the right direction. But if you are going in the wrong direction, becoming more efficient will actually make the problem worse. For example, let’s say your company wants to grow its revenue by some amount. As a marketer, you believe you can affect this by producing some additional business from existing customers. So, you are monitoring and improving the inquiries, deals, cost per new deal, etc. The company is growing but its market share is declining. Why, because the growth opportunity is really outside the existing customer segment. So while marketing is becoming more and more efficient at generating business from existing customers, the company’s market share is actually declining and the competitors are achieving greater market dominance.

What’s really important is effectiveness. In the end, it doesn’t matter if your business is spending the least amount possible or your demand-generation initiatives are streamlined. What matters is whether marketing is solving the right problems and moving the right business needles.

Before you start thinking about how to improve your efficiency, step back and think about how marketing is expected to move the needle and measure its effectiveness. Don’t misunderstand, efficiency is extremely important and you will need efficiency metrics. Improving efficiency can make a difference, but only if you’re on the right path. And the only way to know that is to have effectiveness metrics in place as well. Efficiency is important, but powerless without effectiveness. Effectiveness opens the door for efficiency.

Peace of Mind as a Key Dimension for Measuring Customer Experience

- Product experience (perception of choices and comparative offers)

- Outcome focus (ability to achieve their desired outcome)

- Moments of truth (service expectations and encounters)

- Peace of mind (confidence in the service provide and perceived expertise of the provider).

- Peace of mind has the strongest impact on customer satisfaction, loyalty and word of mouth.

- Moments of truth are the next most important attributes to positively impact loyalty and word of mouth.

- Outcome focus (the customers’ ability to achieve their goals) effects loyalty and word of mouth but only to a lesser extent than peace of mind.

- After peace of mind, product experience has the strongest impact on customer satisfaction, but not as much impact as the other three dimensions on loyalty or word of mouth.